Africa’s data centre boom triggers shift in power investment priorities

Africa’s accelerating digital transformation is placing data centres at the heart of its future power strategy. Surging demand for cloud services and digital connectivity is redefining the continent’s energy and infrastructure landscape, the African Energy Chamber (AEC) said in an emailed note.

According to the AEC’s State of African Energy 2026 Outlook, data centres are expected to play a pivotal role in reshaping power markets across the continent, ahead of key discussions at African Energy Week 2026.

Global demand for uninterruptible power supply (UPS) for IT infrastructure is forecast to reach 249GW by 2030, with total installed capacity, including cooling and ancillary systems, set to rise to 374GW. For Africa, where mobile usage, cloud adoption and internet penetration are rising rapidly, the challenge is ensuring reliable electricity supply to support this growth.

“Data centres are no longer just a technology story – they are an energy story. If Africa gets the power framework right, digital infrastructure can unlock investment, strengthen grids and accelerate inclusive growth across the continent,” said NJ Ayuk, Executive Chairman of the AEC.

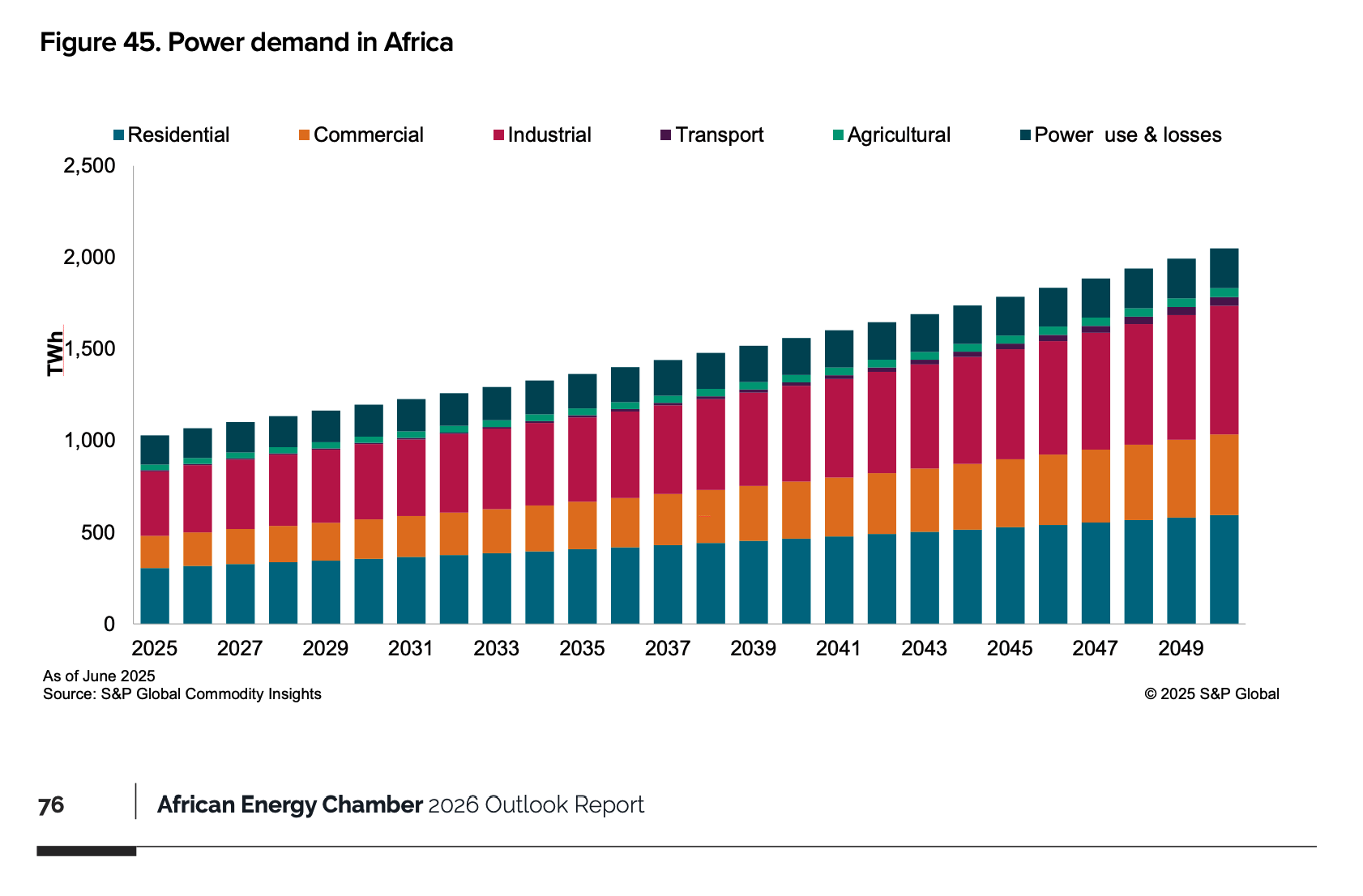

Africa’s power demand is projected to increase from an estimated 1,028 TWh in 2025 to 2,291 TWh by 2050. However, per capita power use remains significantly lower than that of other regions. The continent is witnessing a significant shift towards renewable energy sources, with ~25 GW of capacity procured by governments as of 2024. Additionally, ~11 GW has been secured through private offtake agreements, the report says.

The US is at the forefront of data centre development globally but significant growth is expected across all regions. Africa’s data centre power demand capacity is small with only 1% of the global share but is forecast to achieve a CAGR of 9% between 2024 and 2030 to reach almost 2 GW by year-end 2030.

“Despite this small contribution to total demand, African countries have the opportunity to take the lessons learnt from the exponential growth seen in other regions and apply them to its development,” the report says.

Africa is gradually shifting towards digitalisation. The development of cloud infrastructure in key markets such as South Africa, Kenya, Nigeria and Egypt could accelerate economic growth and facilitate digital transformation across the continent, the AEC says.

Over 2020-2025, the continent invested $34bn in clean power technologies, with 52% allocated to solar energy and 25% to onshore wind. Natural gas is projected to account for 45% of total power generation by 2050. However, challenges related to infrastructure and supply chain issues have hindered its success to date, the report says.

South Africa, Kenya, Nigeria and Egypt are leading the shift, with data centres becoming long-term, stable anchor customers for energy providers. Their high and predictable electricity demand is enabling new generation capacity and grid expansion, creating bankable opportunities for utilities and investors. At the same time, data centres are driving job creation, technological innovation and environmental efficiencies, as hyperscale operators increasingly prioritise renewable energy procurement and advanced energy storage solutions.

“The share of power demand attributed to data centres in Africa remains small but hold significant potential. For instance, in South Africa, they are projected to account for over 5 TWh of electricity demand by 2030, while in Kenya, their contribution is expected to be ~0.7 TWh of projected demand of 19.2 TWh,” the report says.

Yet infrastructure gaps persist. Frequent power outages, limited redundancy and inconsistent regulatory frameworks remain critical obstacles to large-scale investment. The current reliance on Europe-based data centres to serve African digital demand is increasingly unviable, as data sovereignty laws and latency concerns push global providers to establish local facilities.

To meet this demand, cloud majors such as Amazon Web Services, Microsoft and Google are advancing pan-African strategies. In South Africa, the continent’s most mature data centre market, utilisation already exceeds 83% and is forecast to reach 94% by 2030. Demand is concentrated in Johannesburg and Cape Town, where hyperscalers are moving beyond traditional colocation models towards large-scale wholesale infrastructure. Investor appetite remains strong, reinforcing South Africa’s role as a regional digital hub.

In East Africa, Kenya is emerging as the fastest-growing market, driven by public sector policy and strategic projects. The country currently hosts about 40MW of IT load capacity, with a projected compound annual growth rate of 30% through 2028. Under its Vision 2030 programme, Kenya’s flagship Konza National Data Centre is expected to help lift total capacity to over 155MW by 2029, solidifying its position in Africa’s distributed cloud ecosystem.

AEW 2026, set to convene policymakers, investors, developers and utilities, is expected to serve as a key platform for driving cross-sector collaboration and accelerating the integration of energy and digital infrastructure.

Follow us online