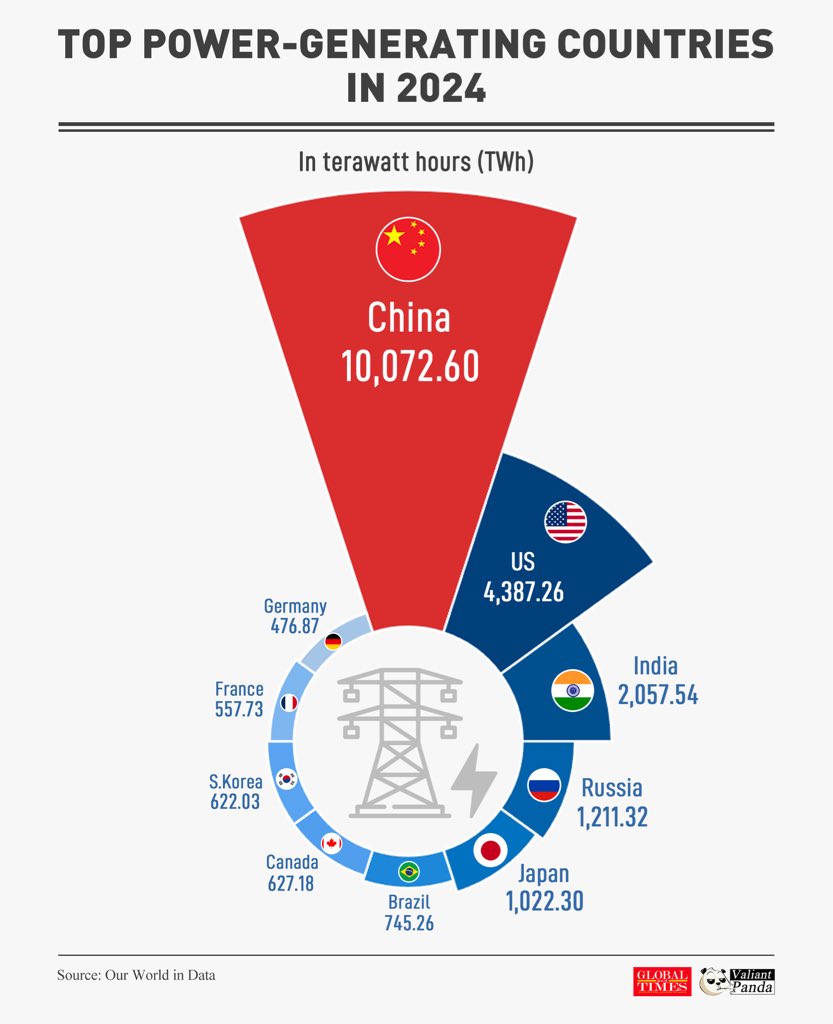

China’s electricity consumption surpasses 10 trillion kWh for the first time, outpacing US and EU combined

↵

China’s annual electricity consumption surpassed 10 trillion kilowatt-hours for the first time in 2025, according to government data released this week, underscoring the country’s accelerating industrial output and surging demand from high-tech sectors including electric vehicles and artificial intelligence.

The milestone, described by Chinese officials as a first in human history, places China’s power usage at more than twice that of the United States and above the combined consumption of the European Union, Russia, India and Japan. The figure reflects growing energy demands from both traditional manufacturing and a rapidly expanding digital economy.

“Electricity is a country’s lifeline and a driving force behind advanced technological progress such as EVs and AI,” state media reported on January 17, citing data from China’s National Energy Administration.

Demand was largely driven by high-end manufacturing sectors and strategic industries supported under the government’s “new quality productive forces” strategy. In 2025, power consumption in the manufacturing of new energy vehicles rose by more than 20%, while wind power equipment manufacturing usage climbed by over 30%.

The digital economy also played a significant role. The expansion of infrastructure including 5G base stations and EV charging stations led to a more than 30% increase in electricity use in the internet and related services sector. The battery charging and swapping sector posted the highest annual rise, with power consumption soaring nearly 50% in 2025.

By the end of November 2025, the number of EV charging guns in China had reached 19.32mn, representing a 52% year-on-year increase, according to official figures.

During the 14th Five-Year Plan period (2021–2025), green electricity accounted for roughly one-third of total power consumption. Between January and November 2025, electricity traded on power markets reached more than 6tn kWh, comprising 63.7% of overall consumption.

China has also established the world’s largest clean power system and carbon trading market, part of its broader transition to low-carbon energy.

“The country has built the world’s largest clean power system and carbon trading market, and its green industries continue to grow,” the report stated.

Electricity prices remain stable amid reform and rising demand

Despite surging demand and global energy market volatility, the cost of electricity in China has remained largely stable over the past three years, due in large part to continued state regulation and targeted policy interventions.

Despite its position as the world’s largest power consumer, China continues to offer some of the lowest electricity prices globally, particularly for residential users. Industrial electricity rates in China typically range from $0.08 to $0.11 per kWh, broadly in line with the US but significantly lower than in most EU member states, where prices for industry often exceed $0.15 per kWh and can reach $0.25 or more, enhancing China’s competativeness on the global market.

Residential users in China pay an average of just $0.08 per kWh, compared to $0.15–0.17 in the US and up to $0.40 in parts of Europe. China’s limited carbon pricing and state-managed grid infrastructure also contribute to keeping costs down. While the EU’s carbon prices regularly exceed $85 per tonne, China’s national carbon market remains in its early stages, with prices closer to $8. The country’s ability to maintain low-cost electricity is a key competitive advantage as it scales up energy-intensive industries such as electric vehicle manufacturing, semiconductors and artificial intelligence.

While China liberalised pricing for industrial and commercial users in 2021, residential tariffs remain under strict government control. In response to widespread power shortages that year—driven by tight coal supplies and surging fuel costs—authorities permitted coal-fired electricity prices to fluctuate by up to 20% from benchmark levels and removed caps entirely for energy-intensive sectors. The move marked a significant shift in pricing policy, aimed at preventing supply disruptions and allowing producers to recover rising input costs.

Coal prices, which had more than doubled at their peak in late 2021, gradually stabilised through 2022 and 2023 as the government expanded long-term supply contracts and increased domestic production quotas. These measures helped to buffer end-user prices and restore grid stability without triggering the sharp increases seen in Europe or parts of Asia.

Meanwhile, China has accelerated power market reform through the expansion of electricity spot trading. As of 2023, more than 63% of total electricity consumption was traded through market mechanisms, up from less than one-third five years earlier. The trend reflects a gradual shift towards pricing based on supply and demand, though the state continues to play a central role in market coordination.

The growing share of renewable energy—particularly solar and wind—has also influenced the generation mix, but has not yet translated into significant changes in end-user tariffs. Integration costs, including grid upgrades and storage, have been offset by subsidies and policy support.

The government’s approach has allowed it to meet rising electricity demand—now the highest in the world—while maintaining broad price stability. However, analysts note that further liberalisation could introduce greater price variation in the years ahead as China deepens market reform.

Follow us online