COMMENT: Trump’s Indian trade deal unlikely to cut Asia off from Russian oil

US President Donald Trump announced on social media that he was slashing tariffs on India from 50% to 18%, after cutting a new trade agreement that will see New Delhi reduce its imports of Russian crude oil dramatically.

The Trump administration doubled tariffs on India last summer after it refused to stop importing oil from Russia due to the deep discounts Moscow offers New Delhi that saw India become Russia’s biggest customer.

However, Trump continues to try and push Russia out of Asia and open new markets for US oil. Since Operation Maduro on January 3 and the de facto take-over of Venezuela he is now also looking for new markets of Venezuela crude after taking control of the trade following the “gift” of 30mn-50mn barrels of oil in January that are being sold by US companies linked to Trump.

China was one of Venezuela’s biggest customers last year, but by January this year it imported no Venezuelan oil at all. Russia imports have also fallen by half in the same month, according to data from Kpler.

While few details of the US-Indian trade deal have been released, Prime Minister Narendra Modi reportedly agreed to buy “a lot more” US oil. A similar deal was forced on European Commission President Ursula von der Leyen last March, when Trump badgered her into a non-binding agreement to buy $750bn of oil and gas from the US over the next three years – a deal analysts called “delusional.” However, despite Trump’s heavy-handed tactics, his efforts to force Russia out of Asia are likely to fail as the discounts Moscow has been forced to offer are simply too big.

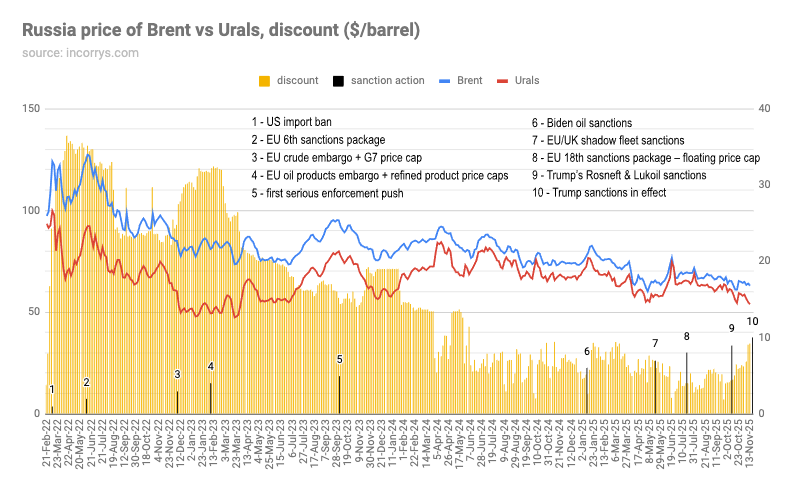

As bne IntelliNews reported, in the first year of the war in Ukraine, Moscow was forced to offer discounts on a barrel of oil of up to $30 to persuade customers to buy it, coupled as Russian oil was, to sanctions risks. However, as time wore on and Moscow built up its shadow fleet, those discounts fell to around $5 (and even briefly fell to zero in 2024) as the trade normalised.

More recently, Trump imposed his first and only oil sanctions on Russia in October, including targeting Russia’s two largest oil companies, Rosneft and Lukoil, which saw the discounts rise again, first to $10 a barrel, but currently they have risen even further since the start of this year to a reported $20 -- the steepest since April 2023.

While Trump’s bullying is likely to reduce the volumes of Russian crude that its Asian customers will buy this year, these discounts are simply too big to ignore.

India and China, Asia’s two largest energy importers, have both already scaled back purchases in response to Trump’s trade tariff threats. A bipartisan bill on Congress’s docket, sponsored by Senator Lindsey Graham, threatening to impose a 500% tariff on any country that does business with Russia is having an effect.

The doubling of tariffs on India last summer to “punish” it for continuing to import Russian crude oil also had an effect.

“Indian imports of Russian crude in January fell to 1.2mn barrels per day, down from the 2025 average of 1.7mn bpd,” Reuters reports, citing Kpler data.

The EU is also due to strengthen sanctions on Russia’s shadow fleet as part of the twentieth sanctions package currently under discussion and due to be released on the fourth anniversary of the start of the Ukraine war on February 24.

Yet despite these curbs, “Russian flows to India are unlikely to disappear,” Reuters said in a commentary. “The price incentives are simply too powerful.”

The discounts are irresistible to Indian refiners. India has just signed a new “mother of all trade deals” with the EU, but a big part of that trade is the export of refined oil products to Europe that is based on India’s import of Russian crude that has been earning India’s refineries a mint as their margins are so wide, thanks to the Russian oil discounts. That refiners like Reliance Industries' Jamnagar complex, will scale back due to EU regulations, but analysts say that the likely outcome is Indian refiners will simply repurpose their output from the export market to domestic consumption.

China’s pivot away from sanctioned barrels has been more dramatic since the US Operation Maduro on January 3 saw America effectively take control of Venezuela’s oil business. Trump has also made it clear that one of the motives for the decapitation of the Venezuela government was to stop Venezuelan oil exports to both China and Cuba. While it remains one of Venezuela’s biggest customers, Venezuela’s share of Chinese imports is only around 4-5%, or 400,000bpd, so an end to that trade will make little difference. Cuba is a different story and is close to collapse for the lack of fuel.

Ironically, the US taking over the Venezuelan oil business and the new export licenses being issued by Office of Foreign Assets Control (OFAC) will only make Russian oil more appealing.

“The bigger issue is simple economics,” Reuters noted. “Venezuelan oil was only attractive to Asian buyers because it was sanctioned—and thus sold at steep discounts.” Now the sanctions regime on Venezuela has been effectively lifted, those discounts will disappear, making the country's ultra-heavy and hard to refine grade of oil even less appealing. Recent offers of Venezuelan heavy crude at just $5 below Brent failed to entice Asian buyers. “The markdown was not enough to make the heavy sulphurous crude competitive,” traders told Reuters.

At the same time, India’s appetite for US crude remains lukewarm. Last year, it purchased only 320,000bpd—around $7.5bn worth—due to high freight costs and limited influence of the US government over pricing.

Finally, Venezuela is unlikely to be in a position to greatly increase output for at least a decade. Production has dropped from its heyday 3.5mbpd to around 800,000bpd in 2025 and the sector needs at least $100bn of investment to modernise and lift production levels again. US companies remain reluctant to commit and Exxon called it “uninvestable” for the meantime unless major reforms are put in place.

Follow us online