Energy investors eye Libya opportunities as degree of stability returns

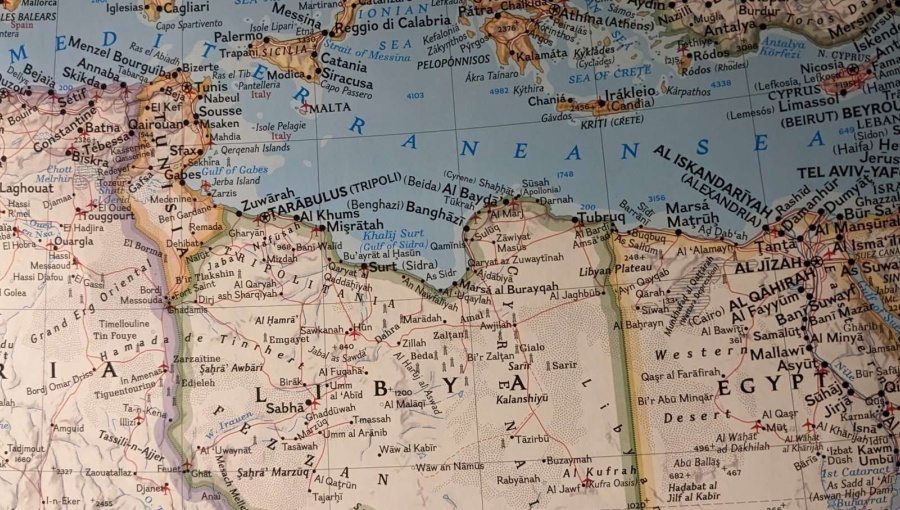

After years of disruption and setbacks, Libya’s fragile hydrocarbon sector appears to be making a tentative recovery, amid plans for major gas exploration and oil production hikes. Yet while the country’s rival administrations have a mutual stake in ensuring the upturn is sustained – as energy sales are their main source of revenue – simmering political tensions could set off security crises, undermining progress.

Recent months have seen significant investor interest in Libya’s substantial oil and gas reserves, with hydrocarbon-related revenues surpassing $17bn in the first 10 months of 2023. Engagement has been driven in large part by rising oil prices; growing demand for gas as Europe looks to wean itself off Russian supplies; and the return of a degree of stability to Libya, as the still-divided country begins to recover from nearly a decade of civil war.

Over the past year, there has been considerable interest from at least six multinational firms in investing in or re-establishing operations in Libya, which has included a multi-billion-dollar deal. The general optimism has been further bolstered by Libya’s declared ambition to increase oil production to 2mn barrels per day (bpd) before 2030. In order to help achieve this goal, an oil and gas licensing round is planned for 2024, the first in almost two decades. However, officials caution that output targets will require much-improved infrastructure, in particular the replacement of pipelines installed in the 1960s.

For oil and gas investors, the outlook, for the near-term, at least, appears promising. But they must exercise caution and develop risk mitigation strategies as they consider new investment and deals in the Libyan energy sector. The country remains politically volatile, with the western internationally-recognised administration in Tripoli and its eastern rival in Sirte still deeply at odds. While the civil war ended in 2020, there has been sporadic violence, with both sides until recently reluctant to make compromises that would put the country on a firmer footing.

The estrangement has seen a delay to a UN-brokered presidential election, initially scheduled for 2021, which will likely push back plans for nationwide elections to later this year. The tensions have been exacerbated by disagreements about the energy sector, the rival authorities often in dispute about control of oil output and the revenue it generates. In 2022, the Libyan National Army (LNA), loyal to the Sirte administration, blockaded oil and gas production and export facilities – blocked oil production in the first half of that year led to a 1.2% economic contraction, according to the World Bank.

The dispute was, however, resolved by replacing the chairman of the National Oil Company (NOC) with an appointment aimed at appeasing the LNA. It was, arguably, a sign of a new willingness to start making concessions to promote the energy sector, despite the entrenched political differences. Then in December 2022, the NOC announced that it deemed the country secure enough for energy companies to resume oil and gas exploration, with several big players in August last year confirming they would do so. Significantly, the NOC says it has the backing of the country’s rival powerbrokers, as it bids to boost energy production and investment.

The détente appears to have contributed to an improvement in economic conditions. An IMF country focus report in June 2023 announced the resumption of the Fund’s surveillance after a decade-long hiatus. It said the “country’s fragmentation hampered policymaking and the collection of key economic data”, but significant efforts had been made to “overcome the economic challenges brought by political conflict”.

Despite the swing in oil production and revenues following the NATO-backed overthrow of Muammar Gaddafi in 2011 that led to the civil war, the IMF said the Central Bank has maintained large international reserves thanks to a fixed exchange rate, capital controls, and other temporary measures. The Central Bank, which split into two branches during the conflict, reunified in August 2023 – a clear sign of a new readiness among the main political factions to work together for the economic good of the country. Such willingness also saw the resumption of trading on the Libyan stock market in December, after a nine-year suspension.

Yet while the economy is beginning to recover amid steps towards stability, oil and gas investors must be alert to a much more enduring business risk – the potential for corruption within the energy sector, where Libyan powerbrokers, including senior officials, politicians and militia leaders are keen to derive personal benefit from foreign investments and deals.

They exploit what the US State Department describes in an investment climate statement as a very unclear and non-transparent regulatory system, “The process of granting licenses and permits is often subject to long and unexplained delays, and the decisions are usually based on subjective and non-transparent criteria.“ Due diligence efforts, therefore, must be prioritised, particularly focused on the NOC’s tendering process and the agendas and loyalties of its stakeholders.

Recognising investor concern over graft, the NOC’s plan to increase oil and gas production includes moves to boost transparency and coordination across the energy sector. That is a welcome development. But even if the NOC is genuinely determined to curb financial irregularities and abuses, it may not possess the enforcement powers or, indeed, the political will. Questions also remain over security. The main political factions might be reluctant to return to violence for now, but there remain risks of intra-factional strife in both camps. In August last year, serious clashes in Tripoli left dozens dead, temporarily suspending flights to the main airport, and then, in October, fighting caused a communications blackout in the eastern stronghold of Benghazi.

Libya’s energy sector does look to be on the cusp of a period of growth, sustained by a realisation among the country’s principal powerbrokers that this is in their mutual interest. Political tensions remain, of course, and may yet lead to disruptions. Earlier this month, protestors closed the Sharara oilfield in response to rising fuel prices and unemployment. However, the Tripoli-based government agreed to meet some of the protestors' demands, which led to a restart in production.

Vigilance, therefore, is key. Investors should seek to anticipate and guard against such instability as well as corruption, in what remains a largely untransparent business environment. So, as oil and gas investors begin returning to Libya, a sound understanding of the risk environment is imperative.

– Risk Advisory is a leading, independent global risk consultancy

Follow us online