Further evidence to come out about mysterious Finnish-Estonian gas pipe leak

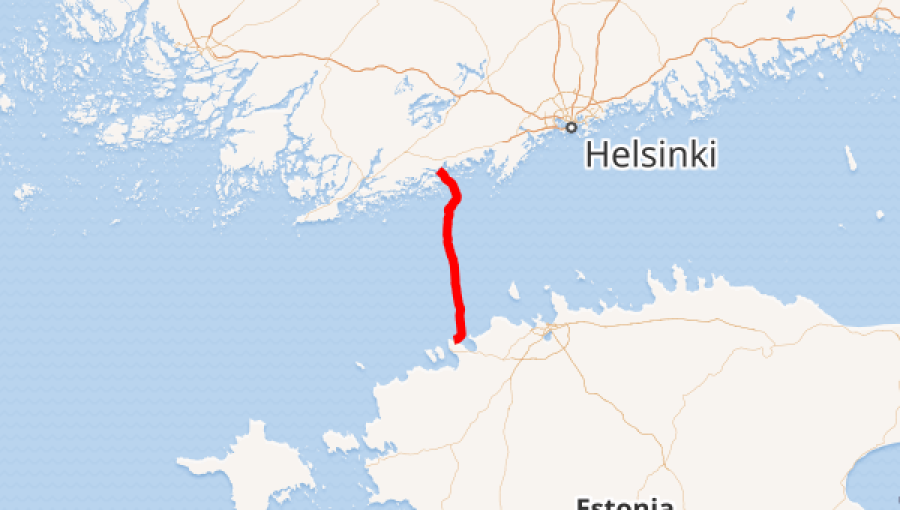

Nordic and Baltic seismologists detected blast-like waves on October 8 – the day that a leak occurred along the Balticconnector gas pipeline linking Estonia and Finland, potentially strengthening the theory that the incident was the result of deliberate action.

European authorities are on a state of high alert about the risk of sabotage to critical energy infrastructure since the Nord Stream pipelines were ruptured last autumn as a result of subsea detonations, and the latest development has only fuelled this concern further. The Finnish government has already said it does not rule out that the leak at Balticconnector was caused deliberately, potentially by a state actor.

Norwegian seismology institute NORSAR said it had analysed data collected in Finland and detected “a probable explosion” near the pipeline, noting that the resulting waves from an explosion have different signals to those caused by earthquakes.

But still there is not enough evidence to conclude that it was an explosion, the institute cautioned.

“We know that it wasn’t an earthquake and we know there was an explosion, but what actually caused the explosion is something to be further investigated,” NORSAR CEO Anne Strommen Lycke told Reuters. “We have seen that there is speculation about whether some ship could have dragged the pipeline and that [this] caused a hole and then a subsequent explosion, [but] that is too early to tell.”

Market implications

Launched at the end of 2019, the Balticconnector is capable of flowing 2.6bn cubic metres per year of gas in either direction. For Finland, the 77-km pipeline was initially crucial as a means of alternative supply for Russian gas. Prior to its completion, Finland relied on Russia for nearly all its gas supply; the Balticconnector enables the country to tap gas in the Baltic region and further afield – including LNG brought ashore in Lithuania and Poland, as well as from a major gas storage hub in Latvia.

Balticconnector proved a saving grace for Finland when Russia’s Gazprom cut off all gas supply to the country in spring last year. Fortunately, in March this year Finland also commissioned its own regasification terminal in Inkoo, which has helped it manage the impact of the disruption at Balticconnector.

In turn, the pipeline allows Estonia to access gas from the Inkoo terminal when necessary.

The leak at Balticconnector contributed to a spike in European gas prices last week to two-month highs, although the larger factors were news that strikes at Chevron’s major LNG facilities in Australia could resume later this week, as well as the market fallout from the Israel-Hamas conflict.

While both Estonia and Finland say that their markets remain well supplied for the time being, risks could increase this winter, particularly if it proves severe. Authorities say they do not expect Balticconnector to resume regular service until April 2024.

The evidence

Finland’s National Bureau of Investigation said this week that external marks had been discovered on the seabed beside the pipeline and that it was assessing the movement of vessels in the area. It added that anchor damage might have been an explanation for the leak. The agency considers mechanical damage, rather than a blast, as the most likely cause, without ruling out an explosion.

Notably, the seismic signal picked up by seismologists had a magnitude of only around 1 – significantly less than the 2.3 magnitude ripples detected at the time of the Nord Stream blasts last year.

"What we are seeing is a seismic signal which originates in the Gulf of Finland at this time, and it has some characteristics that at least make it possible or likely that it is a blast," seismologist Bjorn Lund at Sweden's University of Uppsala told Reuters.

Seismologist Jari Kortstrom at the University of Helsinki added that data indicated it “might be an explosion,” while Estonian seismologist Heidi Soosalu said the signals likely showed a "man-made event".

Russia, for its part, has dismissed suggestions that Russia may have damaged the pipeline. President Vladimir Putin described the claims as “rubbish,” asserting that he had previously never even heard of the pipeline, as it is so small.

He went on to say that the assertion that Russia was to blame was aimed at diverting attention away from the Nord Stream explosions, which Moscow has repeatedly pinned on the US and the UK. The Kremlin has called on the UN to hold an independent investigation into the blasts – but the idea has been rejected by the Security Council. Washington and London deny any involvement.

Various US newspapers have reported that there was a Ukrainian plot to destroy the pipelines, and that the CIA was aware of the plans before they were carried out. And in February, veteran US investigative journalist Seymour Hersh cited unidentified sources as saying that the US navy had carried out the attacks at the behest of the Biden administration. The White House has dismissed that report as “utterly false and complete fiction.”

What next?

Regardless of the cause of the Balticconnector's leak, authorities are taking no chances.

Finland announced at the end of last week that it was tightening access to parts of the Inkoo port where its sole LNG terminal is situated. The UK has meanwhile said it will expand its military presence in northern Europe, including by deploying 20,000 troops to the region next year to defend critical infrastructure against potential Russian attacks.

Finland’s interior ministry said it was setting up a working group to add the port of Inkoo to a national decree that restricts movement and residence permits.

"The decree contains items where movement and residence are restricted under the Police Act," it said in a statement.

Authorities elsewhere in Europe are likely to beef up security across their vital energy infrastructure, fearful of attacks ahead of the upcoming heating season. The continent is well-stocked with gas, with storage facilities nearing full capacity. But geopolitical concerns associated with the Israel-Hamas conflict, and the strike action in Australia, have shown how vulnerable the market remains to even the expectation of supply shocks.

Disruptions to major offshore pipelines and LNG terminals could wreak further havoc on the market this winter, especially in the event that temperatures plunge.

Follow us online