Vice President Kamala Harris promises to cut energy costs, ramp up oil production

US Vice President Kamala Harris has promised to cut energy costs for the American people and ramp up oil production as part of her presidential election manifesto.

“Vice President Harris and Governor Walz will work to lower household energy costs and create millions of new jobs, while tackling the climate crisis, protecting public lands and public health, and holding polluters accountable to secure clean air and clean water for all. They will also safeguard America’s energy security,” Harris said in a policy brief released on September 26.

A Harris-Walz Administration will do this by continuing to invest in a thriving clean energy economy and helping realise the full potential of those investments by cutting red tape so that clean energy projects are completed quickly and efficiently in a manner that protects our environment and public health, the brief says.

The policy brief focused on progress in the transition to clean energy by the Biden administration, policies that Harris is expected to continue.

Since the framework Inflation Reduction Act was passed, which embodies most of the clean energy legislation, companies have announced more than $265bn in clean energy investment projects creating more than 330,000 new jobs, Harris claimed.

“As a result of these investments, national battery storage capacity is projected to double in 2024, solar module manufacturing capacity is going to be more than five times higher in 2024 than just three years earlier, and wind energy production will reach a record high in 2024,” the brief said. “Today, US energy production across a diverse set of sources, including natural gas and renewable technologies, is at historic levels, and the Vice President remains committed to supporting US energy production growth so that we never again have to rely on foreign oil.”

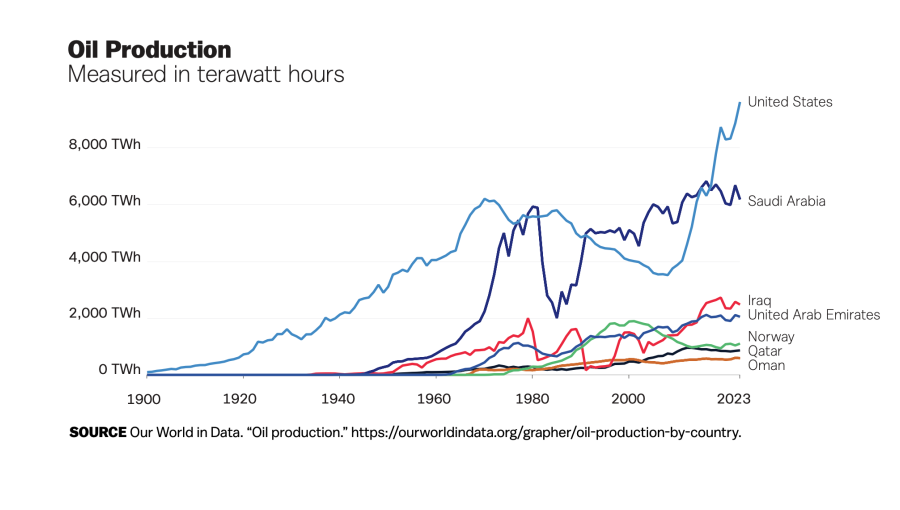

Despite the drive to increase renewable energy sources, US oil production has risen dramatically in parallel over the last years, outpacing the growth of renewable capacity in terms of energy output.

In 2023, the US broke all previous oil production records, averaging 12.9mn barrels per day (b/d), surpassing its previous peak of 12.3mn b/d set in 2019. This growth represents an 8.5% increase in 2023 compared to the prior year, as the US continues to lead global oil production, according to the EIA.

In contrast, the world’s other major oil producers have had mixed results. Brazil, a key non-OPEC producer, experienced a robust increase in production by 12% in 2023, driven by offshore projects. Similarly, Iran saw a 10% rise in output, despite being exempt from OPEC+ production quotas. Norway and China also showed moderate growth of 6.4% and 2.1%, respectively.

However, the main producers of the OPEC+ countries, particularly Saudi Arabia and Russia, experienced production declines due to voluntary production cuts aimed at stabilising global oil markets. Saudi Arabia's output dropped by 9.3%, while Russia's decreased by 1.5%, largely due to these coordinated production restrictions.

Outside of the cartel, the US has been profiting from OPEC’s efforts to boost prices with production cuts and has ramped up production to maximise those profits.

According to OPEC's forecast, from 2023 to 2029, oil demand in non-OECD countries will grow by 9.6mn bpd to reach 66.2mn bpd, while demand in OECD countries will hover around 46mn bpd.

In the long term, from 2023 to 2050, oil demand growth in non-OECD countries will be 28mn bpd, while it may already be declining in OECD countries.

According to the data cited in the OPEC report, India's oil demand could grow the most from 2023 to 2050 by 8mn bpd. In China, demand growth could be 2.5mn bpd, in other Asian countries - 5.2mn bpd, in Latin America - 3mn bpd, in the Middle East and Africa - 4.4mn bpd, and in Russia - 0.2mn bpd.

According to OPEC forecasts, the world's demand for energy resources will increase by 24% by 2050. Oil will remain the most popular type of resource at that time, with a share of 29.3%.

At the same time, the share of renewable energy sources will increase from 3.2% in 2023 to 14% in 2050, while the share of coal will decrease from 25.9% to 13.1%.

The main driver of growth in demand for energy resources by 2050 will be India - demand in this country may more than double to 43mn barrels of oil equivalent per day.

Follow us online