ISTANBUL BLOG: Ordinary Turks take economic beating as media voices insist on positivity on country’s ‘new’ direction

_2.png)

For an insight into the economic beating ordinary Turks have taken since the re-elected Recep Tayyip Erdogan returned to the presidential palace in late May, the observer might start by taking a look at the lot of the Turkish motorist. And the story does not get any prettier after that, with the regime putting the economy through fiscal and monetary contortions in an effort at extracting Turkey from the sorry mess Erdogan's previous terms as president have put it in.

The gasoline price (unleaded 95 octane) at Opet stations on the European side of Istanbul rose to a record high of Turkish lira (TRY) 36.05 ($1.34) per litre on July 24, up 86% compared to the TRY 19.39 registered on May 7 prior to Turkey’s national elections, according to data provided by Opet (chart).

Diesel (Eco Force), meanwhile, reached an all-time high of TRY 35.3 on July 27, up 97% y/y compared to the price of TRY 17.92 registered on May 7.

As of July 27, the year on year diesel and gasoline price increases stood at 44% and 62%, respectively.

Petroleum Industry Foundation of Turkey (PETDER) data shows gasoline sales in Turkey were up 31% y/y to 3.9mn cubic metres (3mn tonnes) in 2021, while diesel sales were up 11% y/y to 31mn cubic metres (11mn tonnes) and autogas sales were up 7% y/y to 3.1mn cubic metres.

In 2022, gasoline sales were up 11% y/y to 4.3mn cubic metres, while diesel sales were flat at 31mn cubic metres and autogas sales were up 7% y/y to 3.2mn cubic metres.

Gasoline prices in Turkey are automatically updated based on a formula. The variables are the Brent oil price, crack margins (CIF Med), the USD/TRY rate and taxes (the special consumption tax (OTV/SCT) and the value-added tax (VAT)).

As unprecedented tax hikes added to the ongoing lira depreciation, Turkey’s fuel prices broke records.

As of July 28, Brent was down 22% y/y to $84 while on July 31 the USD/TRY pair was up 51% y/y to 26.95.

The diesel differential stood at $30, down 15% y/y, while the gasoline differential stood at $31, up 65% y/y.

The average gasoline price in the US was down 13% y/y to $3.7 per gallon ($1 per litre). A record $5.02 was registered on June 14, 2022.

Turkey first applies an OTV to the price of the given product. Then VAT is calculated on the sum of the price of the product and OTV in a scheme that is dubbed “taxing the tax” or “double taxation”.

Effective as of July 10, the Erdogan administration hiked the VAT levied on fuels to 20% from 18%.

With an omnibus bill that became effective on July 15, the OTV on fuel products will be automatically hiked every six months with official domestic producer price index (PPI) inflation.

The government has invented automatic OTV hikes by introducing the mechanism for the OTV on alcohol and tobacco products. In 1H23, the PPI amounted to 15%. As a result, the OTV on one litre of raki rose to TRY 381 from TRY 332. The 20% VAT rate, established by hiking the previous 18% rate in the latest omnibus bill, is added to this amount. The final price of one litre of raki has risen to TRY 769 from TRY 649.

The omnibus bill also provided President Erdogan with the authority to hike OTVs by up to fivefold. The OTVs are fixed sums.

On July 16, the big hit to fuel prices arrived. Erdogan delivered a historically high hike in the OTV on fuel products. He tripled the OTV on fuel products. For instance, the OTV on 95-octane gasoline was hiked to TRY 7.53 from TRY 2.53. A 20% VAT rate is applied to this sum.

Dynamited pricing behaviour

The latest record fuel prices coupled with lira depreciation and sharp tax hikes have dynamited Turkey’s pricing behaviour once again. Even prior to the current storm, Turkey was dealing with hyperinflationary dynamics.

For June, the Turkish Statistical Institute (TUIK, or TurkStat) released official consumer price index (CPI) inflation at 38% y/y. Even the most mainstream pundits currently use the adjective “official” when referring to the TUIK’s inflation rate.

At 38%, Turkey remains in 13th place in the world inflation league based on the TUIK figure.

The Istanbul-based ENAG inflation research group of economists, however, released an inflation figure of 108.6% y/y for June. The ENAG figure calculated for May was 109% y/y.

All of the widespread price and tax hikes as well as the lira depreciation come in the double and triple digits.

On July 26, Halk Ekmek, the subsidised bread production unit of the Istanbul Municipality (IBB), raised the price of ordinary bread by 67% to TRY 5 from TRY 3.

Taxi fees in Ankara were hiked by 50%. Private universities hiked their annual fees by three-digit figures.

On July 28, an Istanbul tenant, Hasan Egilmez, was battered with a golf club by a group of people who included the landlord of his flat. The incident occurred after he rejected the raising of his rent to TRY 100,000 from TRY 30,000. Violence clashes between tenants and landlords are widespread in the country.

On July 24, Turk Telekom (TTKOM) hiked service fees for companies that use its internet infrastructure by 70%. In June, it increased prices for internet subscribers by up to 38%.

On July 22, Erdogan hiked the euro-lira conversion rate for medicine prices by 31%. The rate now stands at 14 while the EUR/TRY rate stands at 30.

On July 10, Erdogan also hiked the value added tax (VAT) on medicines to 10%.

In December, Erdogan had hiked the conversion rate by 37% to 11.

On July 24, Spotify (New York/SPOT) hiked its subscription fee by 33% to TRY 39.99 from TRY 29.99.

On August 3, the TUIK will release the official inflation figure for July.

Favourable external environment

Not only oil prices but external prices in general are, meanwhile, providing a fortunate environment for Turkey’s monetary policy management. The FAO food price index declined to 122 in June, down 21% y/y. The record high was registered in March 2022 at 159.7.

As of July 28, the Bloomberg Commodity Index (BCOM) was lower by 11% y/y at 107. Also as of July 28, the Dutch TTF (Title Transfer Facility) 1-month Natural Gas Futures contract was down by 86% y/y at €26/MWh ($302/1,000 m3 or TRY 8/m3).

Turkey’s tightening

In Turkey, the fiscal tightening led by new finance minister Mehmet Simsek is proceeding on a more “front-loaded” track rather than the “gradual” track seen in the central bank’s monetary tightening.

The government may have decided to tighten its grip by the end of 2023 and deliver relief in the new year, prior to the local elections to be held in March.

On July 20, the central bank’s monetary policy committee (MPC) hiked its policy rate by 250bp to 17.50%. The market expectation was for a 500bp rate hike.

In June, the MPC launched the ongoing tightening process by hiking the policy rate by 650bp to 15% from 8.50%. That move also undershot the market prediction.

The next MPC meeting is scheduled for August 24. As things stand, another 250bp hike appears to be on the way.

Turkey’s policy rate still remains idle on the sidelines, meaning monetary policy is conducted via macroprudential measures and non-capital controls.

Positive reports

On July 27, new central bank governor Hafize Gaye Erkan released her first inflation report and the central bank’s updated inflation forecasts. She also held her first press conference as governor and took questions.

Erkan sharply hiked the central bank’s forecast for end-2023 official inflation to 58% from the 22% given in the May inflation report. Also, the upper boundary has been moved up to 62% from 27%.

Moreover, the central bank expects official inflation to peak at just below the 70%-level in May 2024.

Chart: The central bank’s inflation forecast horizon.

The lira depreciation (which added 8pp) along with wage and tax hikes (8pp) as well as demand conditions (1pp), food prices (9pp) and the change in the central bank’s forecasting approach (11pp) were the main drivers behind the significant hike in the inflation forecast, the inflation report reads. (See the detailed table here on page 59).

The guidance was based on the assumption that the lira will not experience another crash. However, the USD/TRY is still in “the mood” to move beyond the new band of record highs. The latest such high of TRY27.22 was registered on July 19.

TRY28 and TRY30 are viewed as upcoming levels on the USD/TRY chart.

On November 2, the central bank will release its next inflation report and updated inflation forecasts.

The “change in the central bank’s forecasting approach” has been widely described as a positive step towards rationality in policy. However, it begs the obvious question: “What is the policy rate doing at 17.5% if the central bank is expecting inflation to peak at 70%?”

Erkan defends her “gradual” approach to rate hikes, rejecting the idea that she is under political influence, yet the approach brings another dilemma.

All central banks around the world—so including the Fed and including the central banks that can print dollars—apply a gradual approach to monetary policy, according to the governor.

There are, however, unfortunately some central banks that cannot print hard currencies.

Macro and micro measures

Erkan has also complained about Turkey’s knotty set of macro- and micro-prudential measures and non-capital controls. She said that there were “more than hundred” such measures.

bne IntelliNews has been parroting for quite some time how “Even the treasury departments at Turkey's banks can hardly keep up with each announced move.”

The governor is also having problems in counting the number of measures.

Although she complains about the serpentine set of measures, the governor is also relying on the measures as she pursues her “gradual” course in rate hikes.

KKM

On July 11, Erkan introduced a required reserve mechanism on Turkey’s FX-protected “KKM” deposit accounts.

The KKM FX-protected deposits scheme rose to TRY 3.07 trillion as of July 21 from TRY 2.96 trillion as of July 14 while the USD-denominated amount remained flat at $114bn.

As of July 21, the KKM accounts for 25% of total deposits while the share of FX-linked deposits stands at 43%. Overall dollarisation stands at 68%.

On July 25, the central bank tightened the consumer loan growth requirement to 2.5% m/m from 3%. Also, the growth limit on vehicle loans was tightened to 2%.

Additionally, the authority lifted the maximum monthly interest rate burden that can be levied on credit cards to 2.89%.

In June, the central bank cut the securities maintenance ratio for banks that cannot achieve targets in converting FX deposits to lira deposits. It was reduced to 5% from 10%. Simultaneously, the target for the share of lira deposits in total deposits was reduced to 57% from 60%.

Lira rates

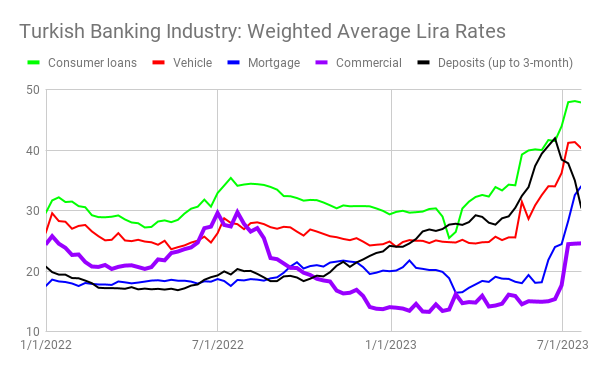

As a result, weighted average interest rates imposed on new lira deposits with maturities up to three months sharply declined to 30% as of July 21 from a peak of 42% as of June 23.

Chart: Lira loan and deposit rates.

Lira loans growth is, meanwhile, gaining pace again. The total lira loans volume on the balance sheet of Turkey’s banking industry rose to TRY 6.8 trillion, after remaining flat at TRY 6.7 trillion, from June 23 to July 7.

Chart: Change in net lira loans volume.

At her press briefing, governor Erkan praised the decline in deposit rates given how the banks have been offering higher deposit rates than loan rates. There is a cap on commercial loan rates. If a bank wants to impose high commercial loan rates, it needs to hold more government papers at the central bank as collateral.

And this brings another dilemma: Why should a Turk keep their money in lira if they will receive 30% interest versus upcoming official inflation of 70%?

Prior to December 2021, when the KKM was introduced, the answer to this question was that the government would expand capital markets to offer investment options other than bank deposits.

For the post-KKM era, officials have been talking about some new instruments. Erkan also said that some new instruments will be introduced. It is a perfectly orthodox approach.

More positivity

Attending to some more window dressing, Erdogan on July 28 replaced all three deputy governors at the central bank. It seems that his “positive” appointments will gradually extend to appointing orthodox cleaning personnel at the central bank.

The media has shown huge interest in the trio of new deputy governors, namely Cevdet Akcay, Hatice Karahan and Fatih Karahan. All three graduated from Bogazici University, an institution that has often drawn tongue-lashings from Erdogan.

One of those lashings came when students and academics at the university were resisting the appointment of a new rector. The media also showed interest on that occasion. Then it lost interest.

Someone who follows Turkey from the vantage point of the mainstream English-language media might easily think that Erdogan has changed his mind when it comes to destroying Bogazici, one of the last institutions in the country that has not yet been totally wrecked by the regime. Unfortunately that is not the case. The destruction of the university continues.

Emrah Sener, one of the deputy governors at the central bank replaced with the arrival of Erkan, also graduated from Bogazici. In 2016, when Sener was appointed as a deputy governor, the media saw his appointment as positive.

Akcay is the most mediatic figure among the new trio. He was found to be present in “Berat’s Box”. The 2000 to 2016 Gmail inbox of Berat Albayrak, Erdogan’s older son-in-law (who served as energy minister and economy czar), is available on Wikileaks.

Akcay is a secularist. However, Berat’s Box suggests that he has always been willing to serve his country.

The media tags people with ideologies. However, its subjects are generally careerist. That requires a perfect elasticity. There is a good Erdogan quote as regards this issue: “I would dress like a [Christian] priest, if required.”

During his interviews, Akcay always brings up the point that he has a PhD from the US. He thinks statistical models are perfectly scientific. He also seemingly does not care so much about the reliability of the data sets that he uses. If the only data sets provided are from the TUIK, Akcay uses them in his regressions.

In the central bank’s latest inflation report, as referred to above, a change in the modelling approach was said to have resulted in a 11pp rise. 11pp more or 11pp less, the proletariat is taught to believe that when some numbers are seen, we have science.

Hatice Karahan has been working as a columnist at hardcore Erdoganist daily Yeni Safak. She also serves as an aide to Erdogan.

According to media reports, Fatih Karahan worked at the New York Fed.

Correlation versus causality

On July 28, Turkey’s five-year credit default swaps (CDS) fell below the 400 level, while the yield on the Turkish government’s 10-year eurobonds remained below the 9% level.

On May 24, unnamed sources told Bloomberg that Turkey’s central bank asked some local lenders to buy the country’s dollar bonds to prevent a CDS spike.

Sentiment on the global markets, meanwhile, remains turbulence-free.

Ortho-heterodoxy

In her press meeting, Erkan was also asked about her thoughts on Erdogan’s infamous inflation theory, simply summarised as higher interest rates cause inflation. She had prepared an answer to this question. No one can make the central bank governor talk about politics during her term in office. Journalists should not spend their energy on such an issue.

During the meeting, the only real question was posed by the representative of Sozcu daily. Erdogan Aktas asked the governor whether she had had a chance to visit a street market in the time since she moved from the US to Turkey. It is rather too hot in the markets, he mentioned.

Erkan replied that the stage from which she was delivering her presentation was also too hot due to the spotlights.

The governor is not too bad at political replies. She is also learning the rhetoric. She talks about Allah and his will as well as serving “our” state and nation.

A little more positivity

Turkey’s new team for the management of the economy has lately relayed in harmony its pleasure as regards the latest capital inflows.

It was when rumours spread that Mehmet Simsek would be appointed finance minister that a glowing positivity first spread across media coverage on Turkey.

Then, another wave of positivity arrived with the appointment of Erkan. And now, there is the third wave of positivity, albeit not as strong as the first two waves, but it still has media coverage in its sway.

The result of these three waves of positivity in the media is so far observed as a $1.5bn inflow into equities. Nothing else.

In parallel, there is big praise for the upcoming capital inflows from Saudi Arabia, Qatar and the UAE. Prior to the elections, some inflows that arrived as deposits on the central bank’s balance sheet were observed. The remainder remains “upcoming”.

Ortho-heterodoxy on the FX market

The governor was also asked about the control of the interbank FX market. She said that the central bank is not intervening in the market via public banks. However, it is directly selling FX to the local banks out of the market.

There is also another neglected question here. How is it that the USD/TRY rate is again drawing a straight line, this time just below the 27-level.

The regime’s “native and national FX teams” may be at work in the public banks.

Despite the regime’s latest U-turn and retreat into economic orthodoxy, Turkey’s FX market is still not free. Officials are indeed still controlling the interbank market via the government-run banks.

However, the interventions are at a lower level than the FX inflows on to the central bank’s balance sheet. Exporters are still obliged to sell up to 40% of their FX revenues to the central bank. As a result, the reserves are recovering from negative levels that are unprecedented.

As the lira has lately been allowed of the leash to depreciate, the central bank’s net FX reserves rose to $14bn as of July 21 from the record low that was registered as minus $6bn on June 2.

The gross reserves rose from $98bn as of May 26 to $114bn as of July 21. The figure stood at $130bn as of February 3.

The central bank’s net FX position (net reserves minus the Treasury’s FX account) stood at $3bn as of July 27.

As of July 21, the central bank’s net open FX-denominated swap stock stood at $60bn. Swaps are off-balance sheet items. To reach the exact situation regarding reserves, swaps should be excluded from the figures above.

The recovery in the reserves does not mean that the central bank has taken away its control of the FX market. It has eventuated because the inflows (rediscount credits, export revenues and so forth) are bigger than the FX sales via public banks.

Amid the booming lira supply and hard currency outflows via significant trade deficits, Turkish officials succeed in keeping a clammy grip on the lira by leaning heavily on bankers into blocking (achieved with non-capital controls) and suppressing (achieved with macroprudential measures) domestic FX demand. Also supportive are unidentified inflows and other assistance from “friendly countries”.

Another ladling of positivity

In the inflation report, the central bank estimated that a 10% increase in the FX rates adds 2.5pp to consumer inflation in a one-year period.

The authority also estimated the possible impact of the 34% minimum wage hike, delivered in July, on consumer inflation at around 3-4pp.

The recent exchange rate developments together with the strong demand point to risks in pricing behaviour for durable household goods, mainly vehicles, white goods and furniture, the report also read.

The central bank aims to confront these developments by introducing selective credit tightening measures. White goods sector representatives were quick to voice concern over possible limitations on instalments in credit card purchases.

The central bank estimates recent tax and fee hikes will add about 5-6pp to annual inflation (see the detailed table on page 31 here. Currently, the full report is only available in Turkish. In the coming days, the English report will be published here).

It is estimated that the natural gas price will add about 1-2pp to annual inflation in November.

Turks surrounded by positivity

The Turks, meanwhile, terrified of the lira plunging even further, are still piling up cryptocurrency, cars and gold, in addition to hard currencies.

Follow us online