The battery revolution

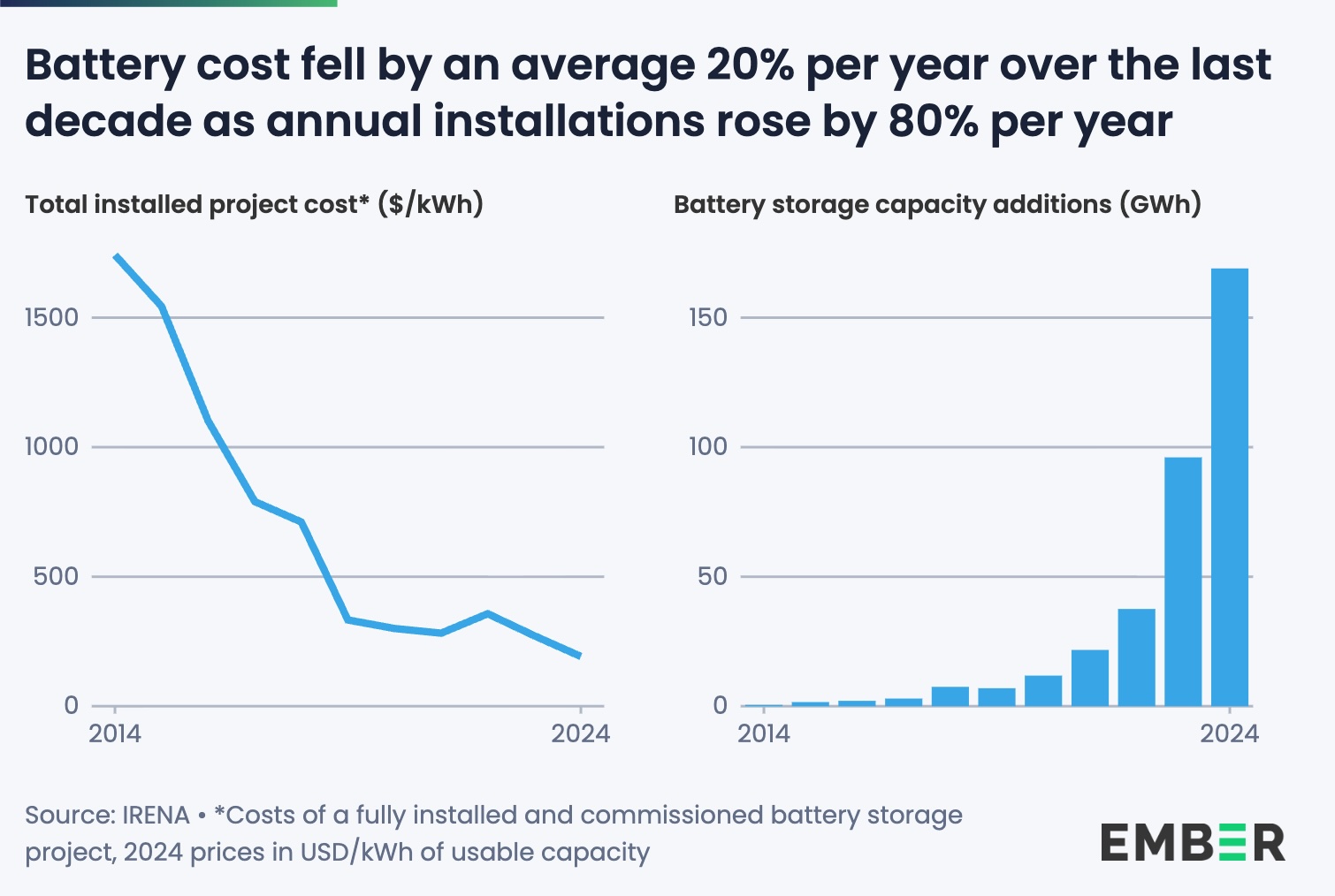

The big drawback with wind and solar energy is they don’t produce any power when the wind doesn’t blow or the sun doesn’t shine. But that so-called “baseload” problem is melting away as a battery revolution is underway. Prices for batteries have tumbled, clearing the way for store power on a blustery summer’s day to be used on calm and chilly nights when demand peaks.

Battery prices are tumbling. Years of investment have solved many of the technological problems that allow for large-scale battery arrays to be attached to renewable power sources and solve the baseload problem.

Now the business is reaching critical mass, as the sharp decline in battery storage system prices is reshaping the economics of clean energy deployment and enabling faster integration of renewables, according to new analysis published by Ember and BloombergNEF (BNEF).

“Battery storage system prices continue to fall sharply,” analysts at Ember wrote in a report. “This is enabling renewables to become a true alternative to fossil-fuelled baseload generation, especially in emerging markets.”

According to BNEF data cited in the report, average global prices for four-hour lithium-ion battery storage systems fell by 28% year-on-year in 2023, dropping to around $260 per kilowatt-hour for fully installed systems. That figure is expected to decline further as manufacturing scales and supply chains stabilise following recent global disruptions.

“Storage is no longer a future technology—it is a present-day solution,” Ember noted. The report points to a record 42GW of new battery storage capacity expected to be deployed globally in 2024, with the US and China leading installations, but with significant growth also forecast in India, Australia and the EU.

Battery storage is the missing piece of the green energy puzzle. The cost of power produced from renewables, and solar in particular, has also been tumbling as the technology and manufacturing tech matures. Today green energy has become the cheapest source of power available to the government. Going green is no longer a development bank nice-to-have item. It has become a cold commercial decision as renewable power is the cheapest of all the options and does not come with the strings and geopolitics of things like hydrocarbons. Global South countries and developing nations are throwing themselves into rolling out new green energy renewable generating capacity as a result.

“The value of storage lies in time-shifting renewable energy, not just in absorbing surplus generation,” the report said. “That makes it an essential pillar of energy security and flexibility.”

Beyond cost declines, regulatory reform is also improving the investment outlook. Markets are increasingly designing incentives that reward fast-responding, flexible assets.

The change in the equation has already had a practical knock-on effect, flipping ESG investments from a marketing ploy to appeal to environmental sensitive retail marketing play to a hard-nosed mainstream infrastructure investment. A decade ago green bonds were rolled out as an investment fad, but soon lost their shine as too many companies were guilty of “greenwashing” to tap the new pool of money. However, with batteries attached, now that renewables are the most competitive energy source and need large amounts of capex to build new generating facilities, these bonds have become a must-have holding. Investors are rapidly shifting their view of clean energy from a niche ESG allocation to a core economic strategy, and the advent of artificial intelligence and data centre expansion, which is expected to triple the demand for power in the coming decades, has only added to the imperative of providing more power. Despite political setbacks in the US and Europe, capital has flowed into green assets at record levels in 2025, with global green bond loan issuance reaching $947bn.

“New capacity mechanisms are being designed to support clean firm power,” Ember stated, referring to recent policy shifts in the UK, US and parts of Asia.

Ember analysts argue that grid-scale batteries are now economically competitive with gas peaker plants in several markets, and this dynamic will accelerate as costs fall further. “Where gas peakers were once the default option for flexibility, batteries are now taking their place,” the report noted. “We are witnessing a step change in how power systems are planned and operated,” Ember concluded.

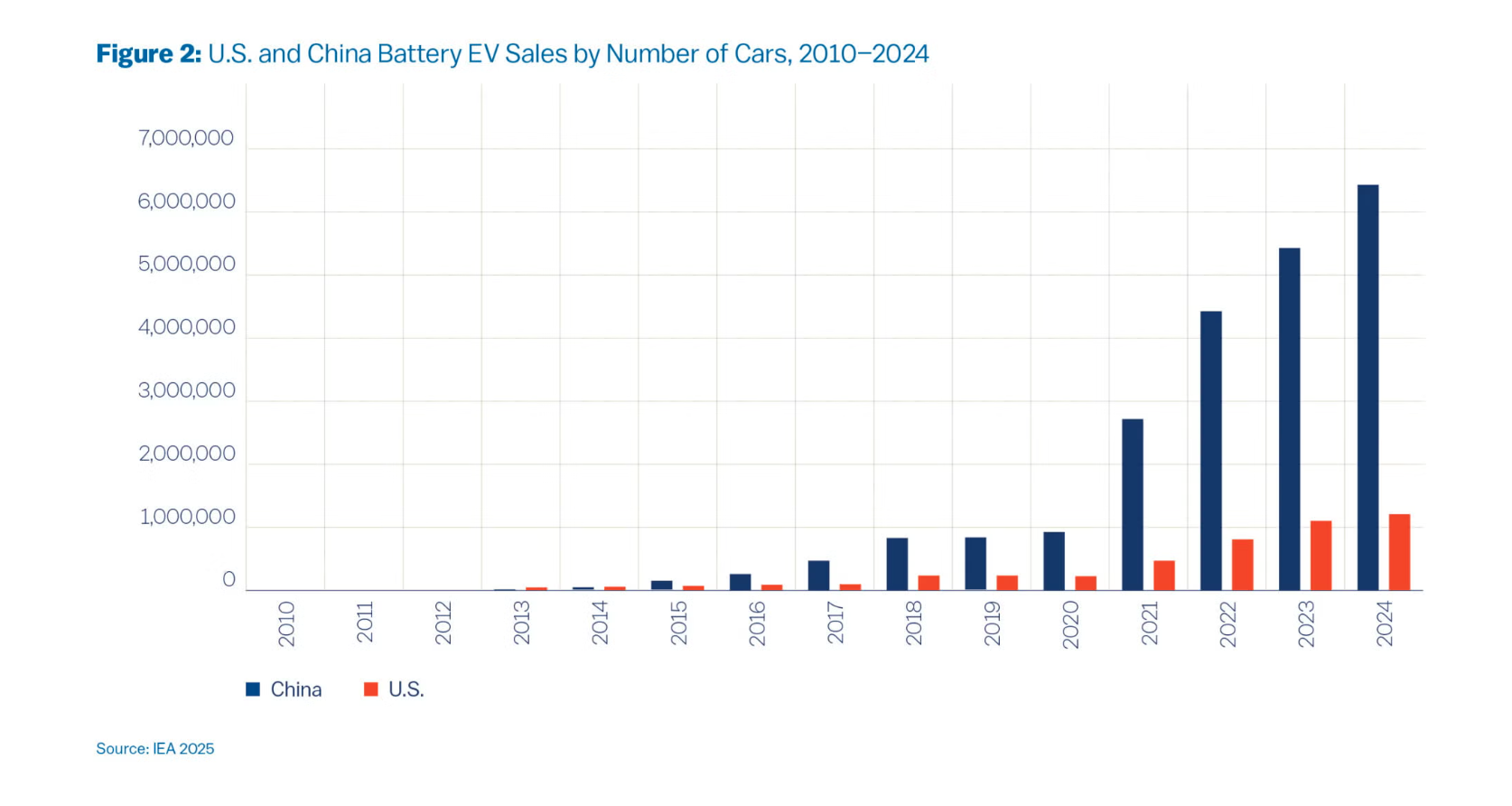

China is the driving force

Most of the progress has been driven by China, which has invested heavily in developing battery technology and is also home to most of the processing of the critical minerals and rare earth metals (REMs) needed to make batteries, most obvious in the explosion of EV sales in the last few years: China sold 433% more EVs in 2024 than the US and is now the largest car maker in the world, with electric vehicles account for half of all sales in 2025. China now dominates the lithium-ion (Li-ion) battery production and is now exploring the far more common sodium-based battery technology. Lithium-ion batteries, and electric vehicles themselves, require critical minerals like lithium, cobalt, nickel, copper, graphite, and assorted REMs.

Economies of scale and heavy investment into R&D have allowed China to overtake other players in the market. Germany was the pioneer of solar panel technology, but last year closed down its last solar panel company as not only as China’s solar panels of better quality, but they are cheaper too. And not only has China invested in the panels, but it has also invested heavily into solar panel manufacturing technology too giving it an unassailable double whammy lead in the business.

It’s the same with batteries. Although the lithium-ion battery industry began with researchers from the U.S., Japan, and South Korea, Chinese companies such as car-maker BYD and CATL, the world’s biggest battery-maker, dominate the global battery industry today.

The first commercial lithium-ion battery was released in 1991after Japan’s Akira Yoshino’s carbon-anode cell made it safe enough for Sony to commercialize it and won Akira a Nobel Prize. Through the 1990s and 2000s, manufacturing clustered in Japan and then South Korea continued to develop the technology, but from the late 2000s, China fused industrial policy with scale and took over. In 2009 “Ten Cities, Thousand Vehicles” pilots and subsequent subsidies, plus the “Made in China 2025” programme nurtured firms like BYD and CATL to build a full mid-stream and cell base that still dominates global markets today.

CATL is now at the forefront of a multi-billion-dollar wave of overseas manufacturing expansion by China’s clean technology firms, with a facility in Germany in operation and other sites planned in locations including Hungary and Indonesia amongst other projects.

And the other BRIC nations are increasingly getting into the game. Brazil is set to hold its first electricity auction for grid-scale batteries in April, and Chinese companies — which have already invested heavily in the country’s power sector — are expected to be leading contenders, potentially bidding against the likes of Tesla Inc. and Petroleo Brasileiro SA. Between 2007 and 2024, power-sector projects accounted for 45% of China’s investments in Latin America’s largest economy, totalling $35bn, according to the non-profit Brazil-China Enterprise Coalition.

Chile has been an early adopter and plans a significant battery expansion over the next five years. Argentina awarded 667 megawatts in its first-ever energy storage auction last September, with capacity expected to come online by 2027. And Mexico’s state utility has announced at least 2.2 gigawatts of storage in its five-year expansion plan, according to BloombergNEF.

Follow us online